One of the decisions home buyers usually make is what type of mortgage to to use for financing. The old standard 30 year fixed rate mortgage is still king, but many are taking a long look at the upstart 15 year fixed as well.

Choosing the mortgage starts with qualifying. It is important to first understand how much house payment the lender will allow you to have and then to understand your comfort level for that payment. Many people, understandably, qualify for a payment higher than their comfort zone allows. A decision must be made on a target payment and then, based on that and the amount of down payment, the target price range.

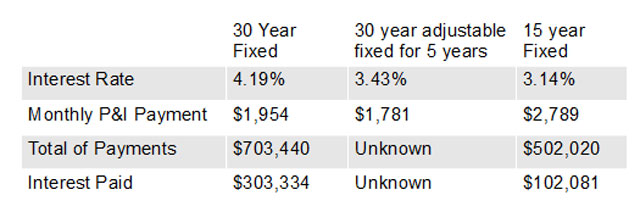

The 30 year mortgage is often chosen over the 15 year because the payments will be lower, enabling a higher target price range. Sometimes an adjustable rate mortgage is chosen over the 30 year fixed rate for the same reason. But sometimes the best decision is to reduce the target price range and opt for the 15 year mortgage. Let’s look at an example.

Assume you are buying a $500,000 home, putting $100,000 down (20%), mortgaging the remaining $400,000. You are qualified for a much larger mortgage but you’ve selected the $400,000 target because the resulting payment more closely matches your comfort zone.

First, let’s deal with that Adjustable. Yes, you could save a couple of hundred dollars a month to start and for the first five years. But it is an Adjustable mortgage, and it will adjust – possibly up, possibly down – in five years. Because the rate will change, you really have no idea what the total of payments will be or how much interest you will pay over the life of the loan. Still, this has been a viable alternative for homebuyers who are stretching to buy the maximum house for the minimum payment, especially in situations where they are fairly certain they will not remain in the house more than five years. If $2,000 was your target payment, the Adjustable would enable you to take on $50,000 more mortgage, boosting your target price to $550,000.

The big comparison is between the 3o year and 15 year fixed rate mortgages. True, the 15 year costs $1,000 MORE each month, but . . . your home is paid for in 15 years and you will have saved over $200,000 in interest! Still, that $1,000 looks large . . . but maybe if you reduced your target price by, say $50,000 – which would drop the payment to $2,440, it would be worth the extra money each month! Or maybe, since you reduced your target payment closer to your comfort zone, you could regard the higher payment – for which you qualify – as a kind of forced savings plan. Paying $1,000 more each month on your mortgage accelerates your accumulation of equity and facilitates the rapid development of a strong financial asset: your home!

The point is this: a mortgage is a critical piece of your financial life. It is a tool to be used to help you accomplish your financial goals. When making mortgage decisions it is important to get expert advice; and that’s what we offer you at Help-U-Sell Honolulu Properties. If you are weighing a mortgage decision, we’d be delighted to help you evaluate your options.