Flashback: 1999

Sunday morning is spent with the classified section of the newspaper spread on the kitchen table. Bob and Sue are circling ads for homes that might meet their needs. They have been at this process for several weeks and have it down to a fine science. The current pool yields five that might work, which means five calls to five real estate agents, one of whom is sharp enough on the phone to set up a showing appointment. Bob and Sue like this agent and spend the next four Sundays looking at houses with her, eventually buying one.

Those were the days when the primary value of a Realtor was providing access to proprietary information about homes for sale. Without the help of this kind of gatekeeper, home buyers had a very difficult time finding properties. There was no Internet, no public property portals, no readily available information on past sales and so on. The only way you found a home on your own was by reading classified ads or noticing for sale signs.

Today it’s very different! Public websites like Trulia, Zillow and Realtor.com have put all of the information about homes for sale in the hands of consumers. Though the data on those sites is somewhat flawed and often out of date, we are fortunate here on Oahu to have the home search capabilities of our Help-U-Sell website. Connected directly to the MLS, it provides consumers with the most up-to-date and accurate information available. We give you ALL the information on houses for sale because we believe house hunting should be a partnership. Many of our home buyers participate in the home search process, searching online for possible matches and giving feedback on properties we select for them. They like to be involved in the home search process.

This new breed of home buyer relies on us to make sure they don’t miss something new or not on the public portals. They also look to us for information on neighborhood values, past sales, planned development and so on. Often these buyers want to drive by a property that seems appealing before actually making an appointment to tour it – another reason to make sure you are maximizing curb appeal when you house is on the market. With this level of home buyer involvement, house hunting time has diminished as has number of properties toured before making a decision.

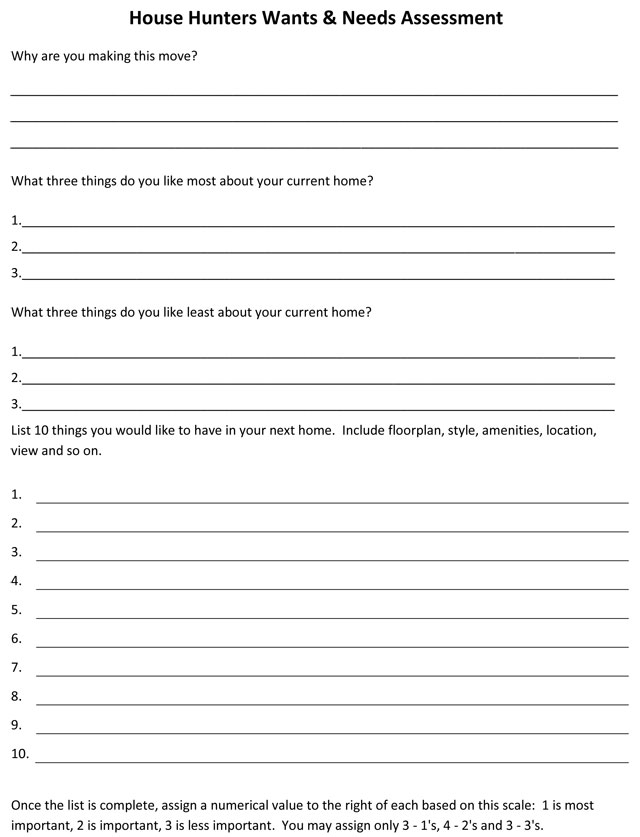

When we encounter a new home buyer, one of the first things we do is have an in-depth conversation about their housing objectives. We want to understand not only their wants and needs about floor-plans, house styles and neighborhoods, but also what’s most important to them from a lifestyle and location standpoint. We also help them understand their borrowing capability and fine tune their price range expectations. If they’d like to participate in the search process, we set them up with a website account which gives them access to properties in the MLS. This lets them search for homes for sale just like an agent. We search as well, communicating frequently about what’s available and what might fit their needs. We tour homes that seem to match until the right one comes into view. It might be the first home we tour or the fifth or the fifteenth. All the while we are answering questions about construction, zoning, financing, potential improvements, neighborhood values and so on.

From that moment on we are constructing an offer, negotiating with the seller, arranging for financing, setting up and managing inspections, collecting required paperwork and orchestrating all of the details that enable a closing to take place. It is a complex and at times confusing process that ends with smiles all around as the keys are passed to the buyer at the closing table.

Today, the value of an agent is so much more than simply providing access to information about homes for sale. We still do that, but we do it with great new consumer oriented tools. Our primary value, though is in helping our buyer clients make really good decisions and then navigating everything that needs to be done to manifest those decisions. We’d love to help you in your home search. Call us today for a free, no obligation consultation.