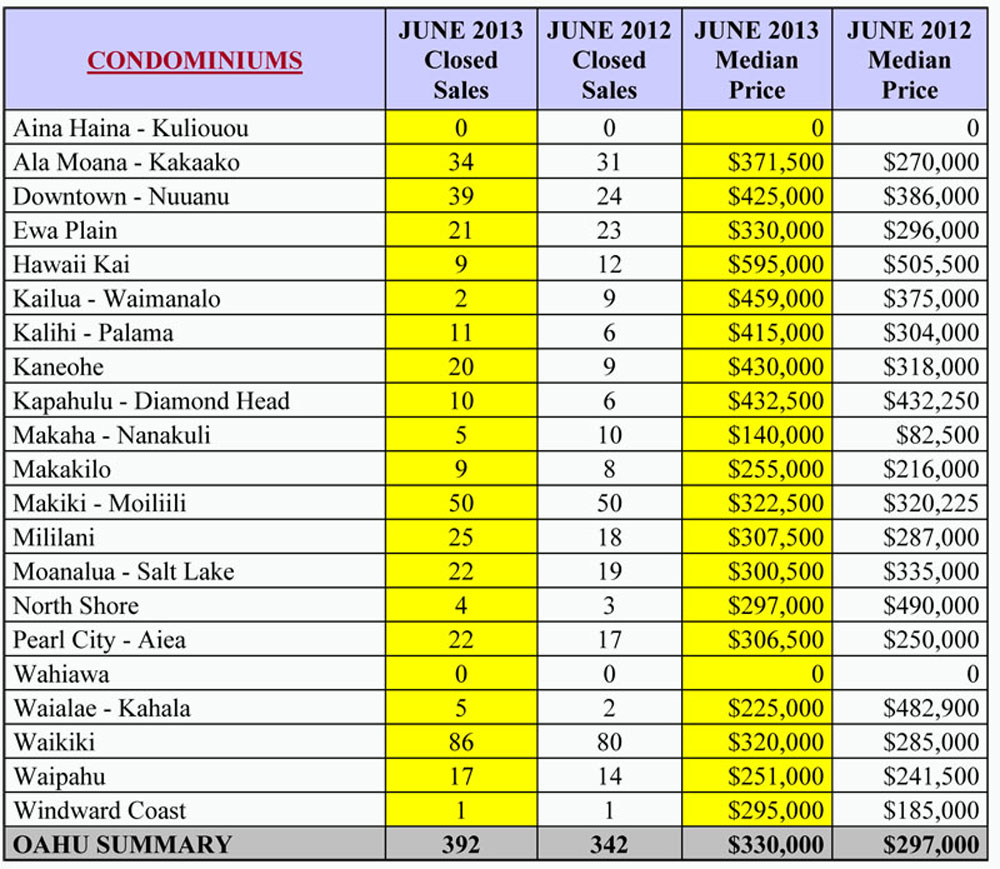

A new real estate report from the Honolulu Board of REALTORS is out, this time focused on the month of August. The Board, using MLS data, is providing great insight into the improving Hawaii real estate market by specific neighborhood. The highlights are below but you can access a detailed report on any neighborhood by clicking the neighborhood name. For the full report, including summaries, click HERE .

| Neighborhood | 2013 Sales | Price Increase Over 2012 | Sale Price as a % of Listing Price |

Average Days on Market |

| Aina Haina – Kuliouou | ||||

| Single Family Homes | 55 | 7% | 100.0% | 13 |

| Condos | 4 | 30% | 98.8% | 25 |

| Ala Moana – Kakaako | ||||

| Single Family Homes | 2 | * | * | * |

| Condos | 286 | 10% | 101.2% | 30 |

| Downtown – Nuuanu | ||||

| Single Family Homes | 62 | 1% | 95.1% | 31 |

| Condos | 244 | 20% | 95.3% | 31 |

| Ewa Plain | ||||

| Single Family Homes | 385 | 12% | 99.0% | 17 |

| Condos | 225 | 5% | 97.6% | 15 |

| Hawaii Kai | ||||

| Single Family Homes | 122 | 12% | 99.5% | 22 |

| Condos | 141 | 8% | 100.4% | 14 |

| Kailua – Waimanalo | ||||

| Single Family Homes | 211 | 12% | 97.8% | 15 |

| Condos | 63 | 8% | 101.9% | 9 |

| Kalihi – Palama | ||||

| Single Family Homes | 60 | -2% | 95.7% | 25 |

| Condos | 64 | 16% | 100.0% | 18 |

| Kaneohe | ||||

| Single Family Homes | 139 | 3% | 98.6% | 25 |

| Condos | 125 | 3% | 99.5% | 14 |

| Kapahulu – Diamond Head | ||||

| Single Family Homes | 134 | 6% | 101.2% | 14 |

| Condos | 79 | 9% | 97.9% | 28 |

| Makaha – Nanakuli | ||||

| Single Family Homes | 114 | 5% | 94.0% | 42 |

| Condos | 84 | 13% | 89.6% | 33 |

| Makakilo | ||||

| Single Family Homes | 101 | 0% | 100.0% | 20 |

| Condos | 62 | 4% | 96.1% | 16 |

| Makiki – Moilili | ||||

| Single Family Homes | 68 | 7% | 100.8% | 31 |

| Condos | 372 | 6% | 98.5% | 20 |

| Mililani | ||||

| Single Family Homes | 162 | 4% | 100.0% | 15 |

| Condos | 174 | 4% | 99.5% | 16 |

| Moanalua – Salt Lake | ||||

| Single Family Homes | 41 | 9% | 101.5% | 29 |

| Condos | 117 | 8% | 98.7% | 17 |

| North Shore | ||||

| Single Family Homes | 65 | -4% | 94.9% | 37 |

| Condos | 30 | 30% | 98.8% | 53 |

| Pearl City – Aiea | ||||

| Single Family Homes | 157 | 4% | 96.4% | 23 |

| Condos | 193 | 6% | 100.0% | 15 |

| Wahiawa | ||||

| Single Family Homes | 49 | 6% | 92.2% | 11 |

| Condos | 9 | 29% | 93.5% | 40 |

| Waialae – Kahala | ||||

| Single Family Homes | 68 | 13% | 102.6% | 24 |

| Condos | 31 | 7% | 95.8% | 40 |

| Wiakiki | ||||

| Single Family Homes | 1 | * | * | * |

| Condos | 747 | -7% | 95.4% | 32 |

| Waipahu | ||||

| Single Family Homes | 134 | 9% | 98.3% | 21 |

| Condos | 147 | 6% | 101.9% | 12 |

| Windward Coast | ||||

| Single Family Homes | 27 | 27% | 86.5% | 49 |

| Condos | 12 | 4 | 95.3% | 51 |

*The number of transactions in some neighborhoods is so small that information about increases in price and so on is not meaningful.

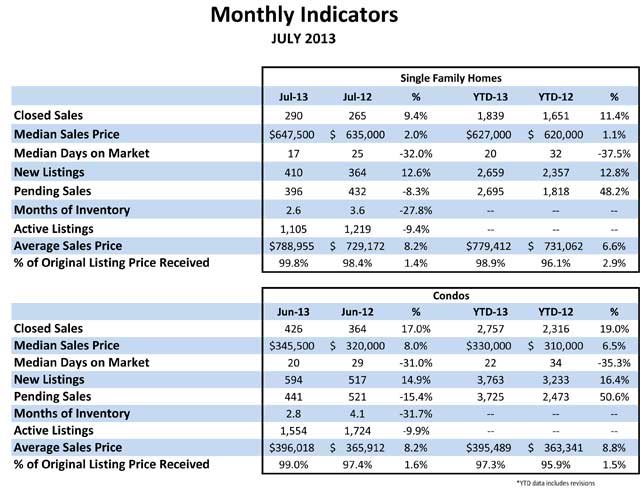

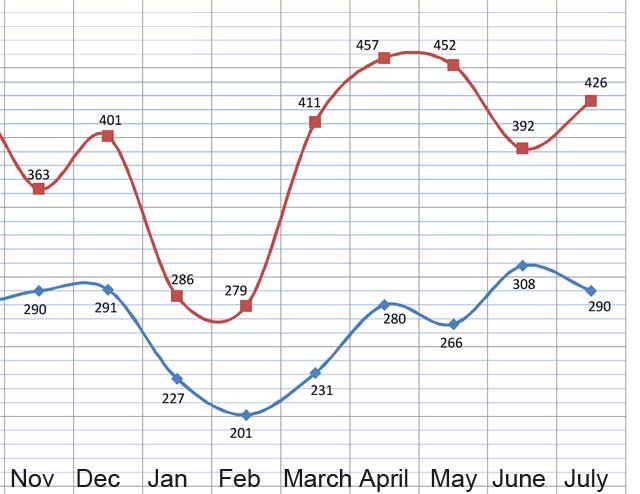

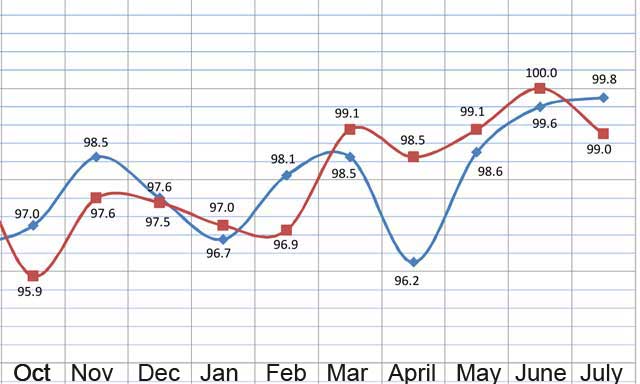

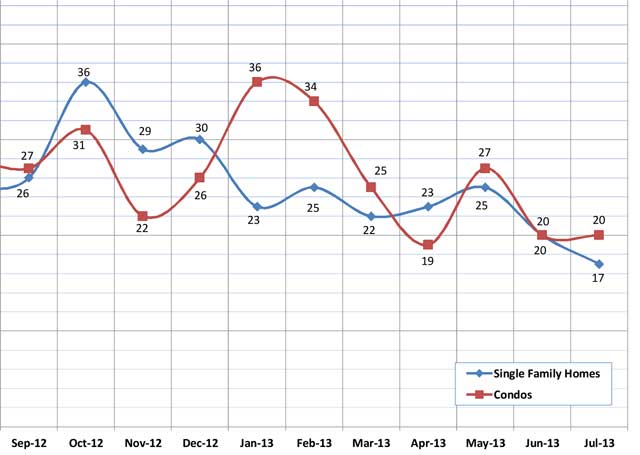

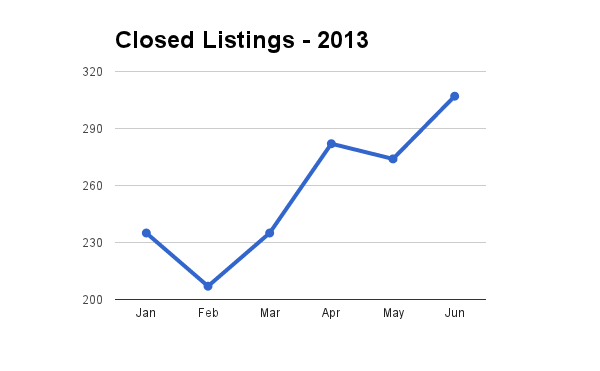

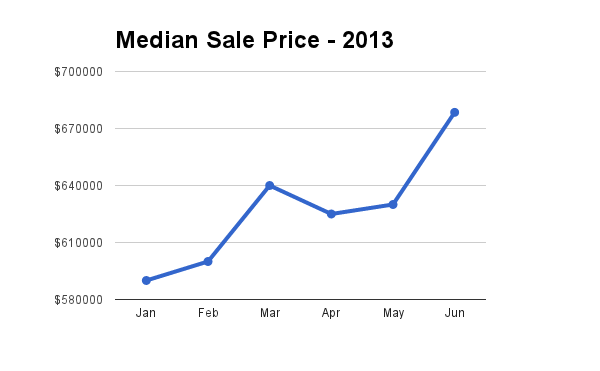

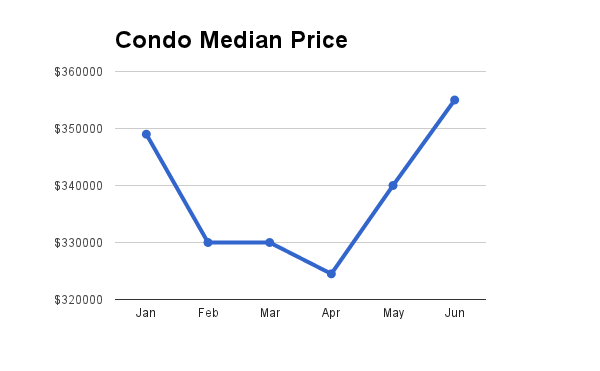

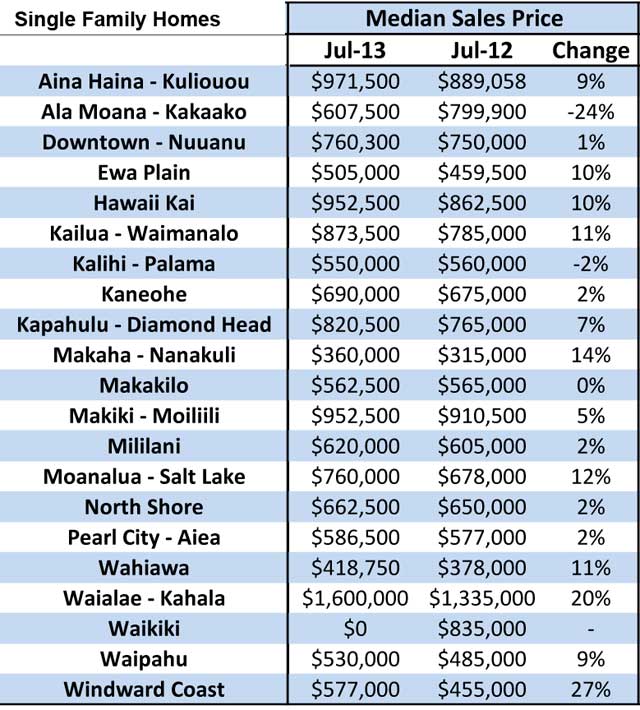

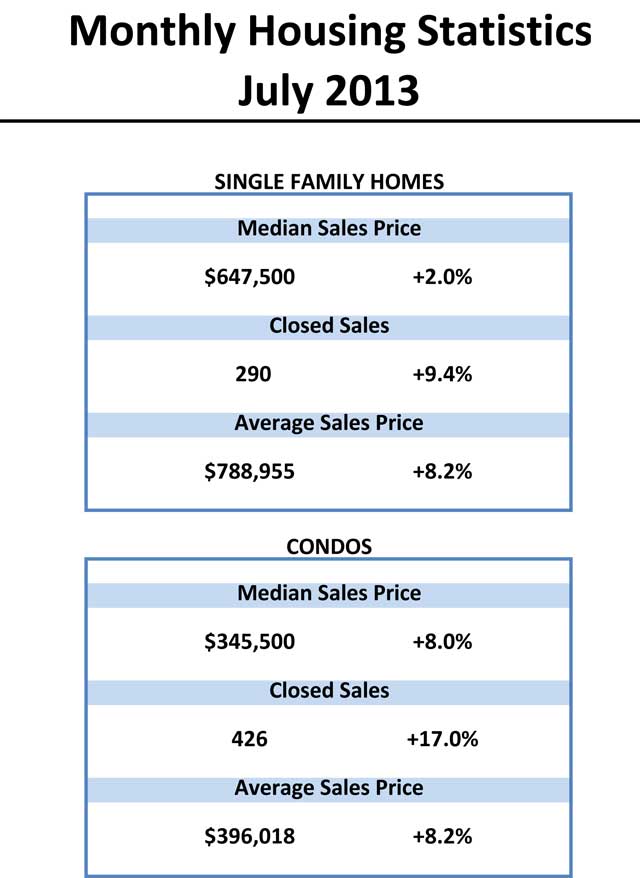

Gains in closed sales and price increases have been solid over the past year. And an 8.2% rise in average prices for both condos and single family homes is great news! Let’s look at these numbers in a little more detail.

Gains in closed sales and price increases have been solid over the past year. And an 8.2% rise in average prices for both condos and single family homes is great news! Let’s look at these numbers in a little more detail.